In this instance Company, XY will take 33.7 days to pay its vendors which means it is not subject to late penalties on its purchases. Paying vendors earlier means the company can take advantage of discounts on various products from the suppliers. Once you get the statements you look at the years beginning and ending account payable balances. Last year’s beginning accounts learn how long to keep tax records payable balance was $110,000 and the ending accounts payable balance was $95,000. As a result, an increasing accounts payable turnover ratio could be an indication that the company managing its debts and cash flow effectively. Investors can use the accounts payable turnover ratio to determine if a company has enough cash or revenue to meet its short-term obligations.

Is it better to have a high or low Days Payable Outstanding?

If the industry has an average payment period of 90 days also, for Clothing, Inc., sticking with this plan makes sense. By carefully managing its average payment period, a company can significantly improve its liquidity position and working capital management. A longer than average payment period allows the company to use its cash for other operations before settling its payables. However, excessively long payment periods may negatively impact the reputation of the company, hindering its ability to negotiate future credit terms.

Average Payment Period Calculator

If a company’s average period is much less than competitors, it could signal opportunities for reinvestment of capital are being lost. Or, if the company extended payments over a longer period of time, it may be possible to generate higher cash flows. APP is important in determining the efficiency of utilizing credit in the near term. Similarly, it helps evaluate the ability of the company to pay creditors in the long term. If the average payment period of a company is low which means that it settles credit payment s faster and on time it is likely to attract good payment terms from the existing and new vendors.

The formula for the average payment period

It’s critical to understand the underlying metrics and strategies that can help accomplish this delicate balancing act. For potential investors and lenders, understanding a company’s APP can reveal important insights into the firm’s cash flow management, financial sustainability, and overall risk profile. Investors prefer companies that demonstrate financial discipline and efficient cash management, for which the APP serves as a significant indicator. The implications of the Average Payment Period go beyond simple financial analysis. For suppliers and creditors, a shorter APP is desirable as it ensures quick payment.

Use average payable period calculator for the effective management of your company’s cash flows

On the contrary, if the average payable period is in line with market practice, it may suggest a lower liquidation risk. On early collection of the funds, the suppliers may have to offer certain discounts. The percentage of discount allowed on revenue is recorded as an expense, which reduces the business profit. However, the benefit of the early collection is that amount can be utilized in the business. However, it has a massive potential to impair working relations with suppliers and compromise the long-term profit of the business.

- For instance, a business can assess its cash flow activities using its APP, including revenue-generating collection processes.

- We believe that sustainable investing is not just an important climate solution, but a smart way to invest.

- On the contrary, if the average payable period is in line with market practice, it may suggest a lower liquidation risk.

- The concept of accounts payable days, commonly known as Days Payable Outstanding (DPO), is pivotal in managing a company’s cash flow and overall financial health.

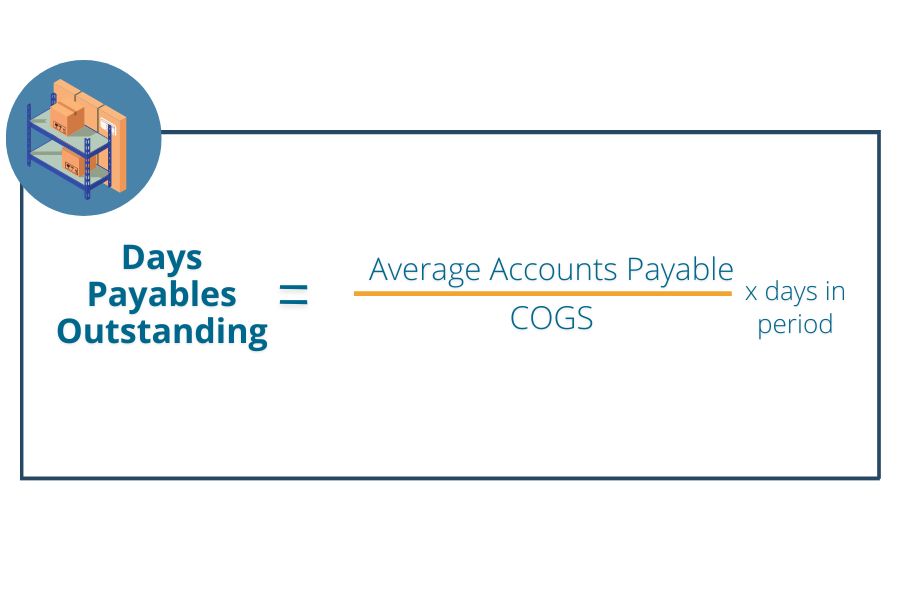

Divide the total amount your company spent on credit purchases during the measurement period by the number of days in the period to use the formula. The business managers need to balance these factors for effective management of the average payment period. If managers are more centered on managing working capital with the accounts payable financing, the business may be more profitable in the short term due to more liquidity. The average payment period represents the average number of days a company takes to pay its supplier invoices. In contrast, the average collection period reflects the average number of days it takes for a company to collect and convert its accounts receivable into cash.

Evidently, analysts and investors find this ratio useful – the goal is to determine whether the firm is financially capable of making the payments. It isn’t of utmost importance if it accomplishes this at the fastest rate possible. However, if they pay their vendors just 4 days sooner, then they would be eligible for a 10% discount on their parts and materials. The average payment period is calculated by dividing the average accounts payable by the product of total credit purchases and the total days in a year. Obviously, if the company does not have adequate cash flows to cover payments at a faster rate, the current average payment period may show the current credit terms are most appropriate.

The average payment period formula is calculated by dividing the period’s average accounts payable by the derivation of the credit purchases and days in the period. Before calculating the average payment period, you need to calculate the average accounts payable of the company. The average payment period calculation can reveal insight about a company’s cash flow and creditworthiness, exposing potential concerns. Or, is the company using its cash flows effectively, taking advantage of any credit discounts?

There are several advantages that come to a company that tracks their average payment period. But the biggest benefit comes from the average payment period being a solvency ratio. A solvency ratio helps a company determine its ability to continue business as usual in the long-term. Once the organization understands its payment patterns, improvements can be made based on current cash flow and production needs.

For example, let’s assume Company A purchases raw material, utilities, and services from its vendors on credit to manufacture a product. When a company knows its DPO, it can better assess whether it is paying its bills quickly which helps maintain good relationships with suppliers. A company usually wants to balance the benefit of paying a vendor early against the purchasing power lost by spending capital early. In many cases, a company may want to be on the good graces of a supplier to potentially receive goods earlier.